How Mortgage Rate Changes Impact Your Homebuying Power

Keeping Current Matters August 20, 2024

Buyer

Keeping Current Matters August 20, 2024

Buyer

If you’re thinking about buying or selling a home, you’ve probably got mortgage rates on your mind. That’s because you’ve likely heard that mortgage rates impact how much you can afford in your monthly mortgage payment, and you want to factor that into your planning. Here’s what you need to know.

Mortgage rates have been trending down recently. While that’s good news for your homebuying plans, it’s important to know that rates can be unpredictable because they’re affected by many factors.

Things like the economy, job market, inflation, and decisions made by the Federal Reserve all play a part. So, even as rates go down, they can still bounce around a bit based on new economic data. As Odeta Kushi, Deputy Chief Economist at First American, says:

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

When mortgage rates change, it affects how much you pay each month for your home loan. Even a small rate change can make a big difference to your monthly bill.

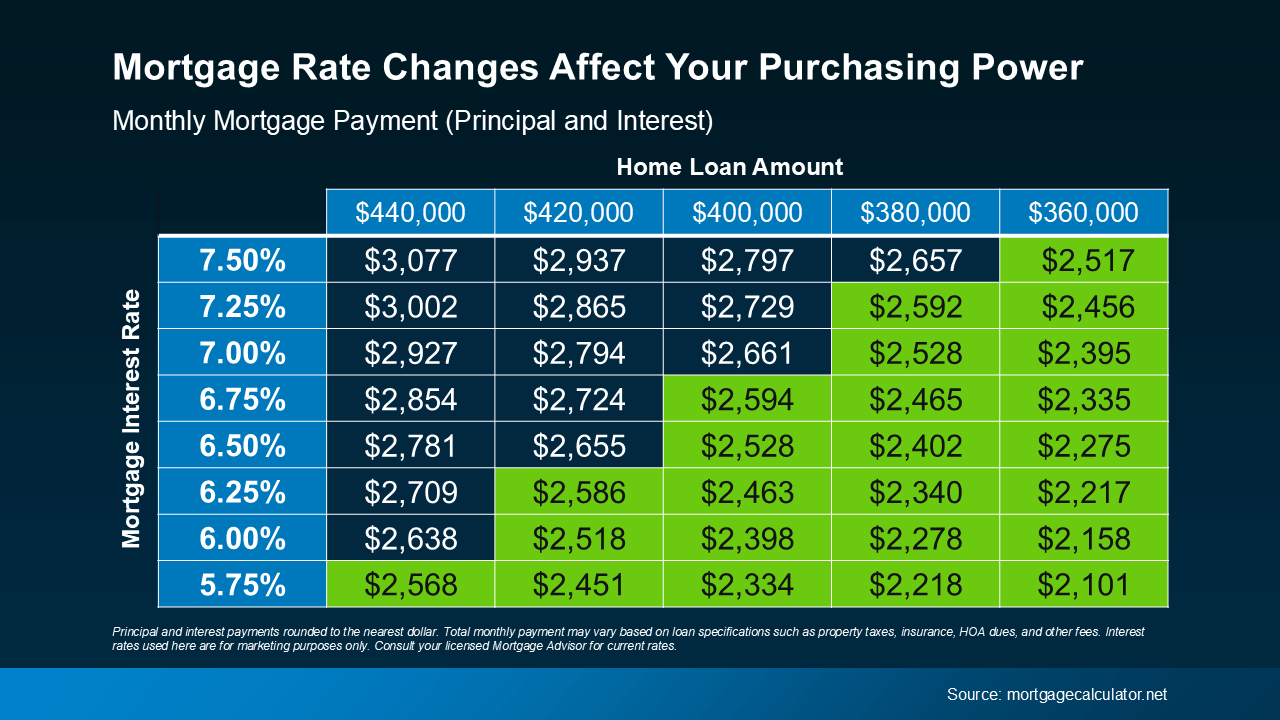

Take a look at the chart below to see how different mortgage rates impact your house payment each month for various loan amounts. Imagine you can afford a monthly payment of $2,600 for your home loan. The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

Understanding how mortgage rates impact your payment helps you make better decisions.

Real estate agents have the expertise to help you understand what’s happening and what it means for you. They can provide tools and visuals, like the chart above, to show how rate changes impact your buying power.

You don’t need to be a mortgage expert; you just need a professional by your side. Someone who can help you make sense of the market and guide you through your homebuying or selling journey.

If you have questions about the housing market, let’s connect. That way you’ll understand what’s going on and how to navigate it.

Stay up to date on the latest real estate trends.

Buyer

March 10, 2026

March 5, 2026

Seller

March 4, 2026

Seller

March 3, 2026

Seller

February 27, 2026

Buyer

February 26, 2026

We Guide Homeowners through the complicated process of selling their home using our 4 Phase Selling Process and 3 Prong Marketing Strategy that alleviates their stress and moves them effortlessly to their next destination. Schedule a 15 Minute Complimentary Strategy Session Today