What You Can Do When Mortgage Rates Are a Moving Target

Keeping Current Matters April 23, 2025

Buyer

Keeping Current Matters April 23, 2025

Buyer

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.

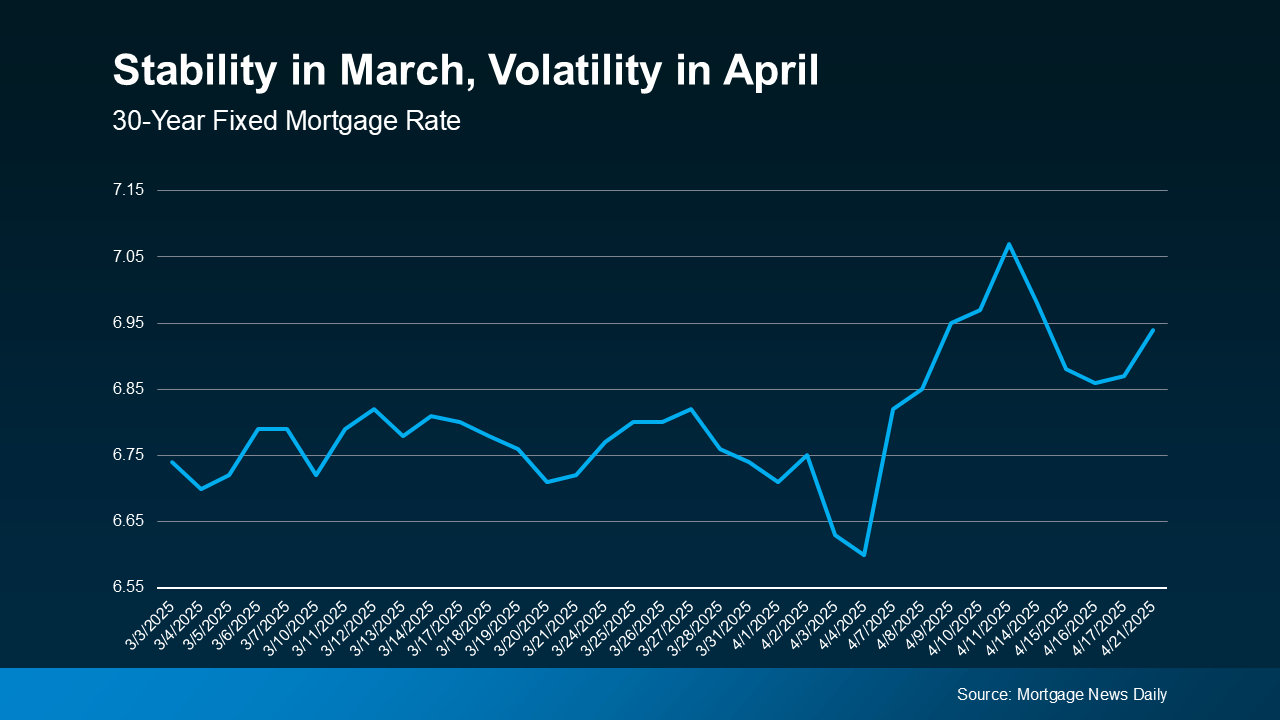

Take a look at the graph below. It uses data from Mortgage News Daily to show that after a relatively stable month of March, mortgage rates have been on a bit of a roller coaster ride in April:

This kind of up-and-down volatility is expected when economic changes are happening.

And that’s one of the reasons why trying to time the market isn’t your best move. You can’t control what happens with mortgage rates. But you’re not powerless. Even with all the economic uncertainty right now, there are things you can do.

You can control your credit score, loan type, and loan term. That way, you can get the best rate possible in today’s market.

Your credit score can really affect the mortgage rate you qualify for. Even a small change in your score can make a big difference in your monthly payment. Like Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Keeping your credit score up is key when it comes to qualifying for a home loan. If you’re not sure where your score stands or how to improve it, talk to a loan officer you trust.

There are also different types of loans out there, and each one comes with unique requirements for qualified buyers. The Consumer Financial Protection Bureau (CFPB) explains:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Always work with a mortgage professional to figure out which loan makes the most sense for you and your financial situation.

Just like there are different loan types, there are also different loan terms. Freddie Mac puts it like this:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most lenders typically offer 15, 20, or 30-year conventional loans. Be sure to ask your loan officer what’s best for you.

You can’t control what’s happening with the economy or mortgage rates, but you can work with a trusted lender and take steps that’ll help you get the best rate possible.

Let’s connect to talk about what you can do today to put yourself in a strong spot for when you’re ready to buy a home.

Stay up to date on the latest real estate trends.

Buyer

August 29, 2025

You may have seen talk online that new home inventory is at its highest level since the crash.

Buyer

August 29, 2025

It’s not unusual for designers to use their own homes as a mad laboratory, fiddling with new materials, half-baked ideas, and “could this work?

Lifestyle

August 28, 2025

It just happens that one of the most accessible and budget-friendly forms of exercise is also the most beneficial for your health: walking.

Seller

August 28, 2025

Now that the market is slowing down, homeowners who haven’t sold at the price they were hoping for are increasingly pulling their homes off the market.

Buyer

August 26, 2025

Sales of new single-family houses in July were at a seasonally adjusted annual rate of 652,000, according to estimates released jointly today by the US Census Bureau a… Read more

Buyer

August 26, 2025

If you’re still worried about having to deal with a bidding war when you buy a home, you may be able to let some of that fear go.

We Guide Homeowners through the complicated process of selling their home using our 4 Phase Selling Process and 3 Prong Marketing Strategy that alleviates their stress and moves them effortlessly to their next destination. Schedule a 15 Minute Complimentary Strategy Session Today