What You Need To Know About Homeowner’s Insurance

Keeping Current Matters March 20, 2025

Buyer

Keeping Current Matters March 20, 2025

Buyer

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it's a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

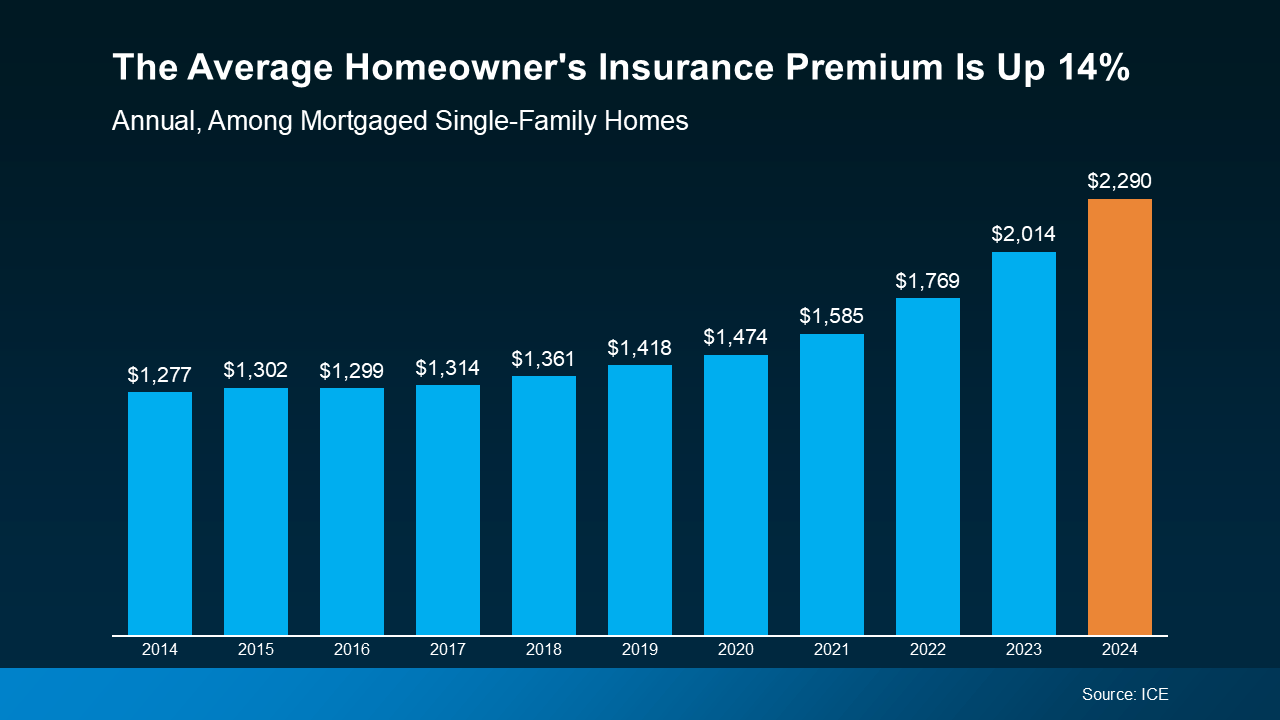

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

What’s your biggest concern when it comes to budgeting for homeownership? Let’s talk through it and make sure you’re set up for success.

Stay up to date on the latest real estate trends.

Seller

December 26, 2025

When your house doesn’t sell, it does more than disrupt your plans, it hits close to home.

Seller

December 23, 2025

Hearing talk about home prices falling? That may leave you worried about whether your house is losing value.

Seller

December 19, 2025

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore.

Buyer

December 18, 2025

You may not want to put your homebuying plans into hibernation mode this winter.

December 18, 2025

Buyer

December 16, 2025

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

We Guide Homeowners through the complicated process of selling their home using our 4 Phase Selling Process and 3 Prong Marketing Strategy that alleviates their stress and moves them effortlessly to their next destination. Schedule a 15 Minute Complimentary Strategy Session Today