Should You Buy a Retirement Home Sooner Rather than Later?

KCM October 10, 2020

Buyer

KCM October 10, 2020

Buyer

Every day in the U.S., roughly 10,000 people turn 65. Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

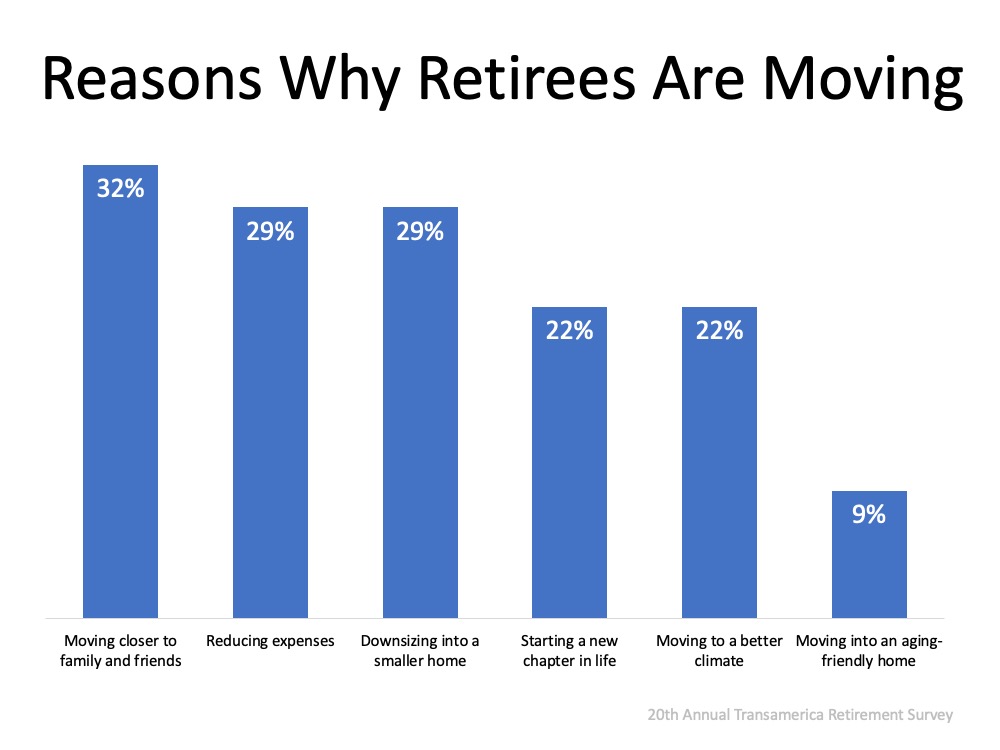

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below):

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local market.

Stay up to date on the latest real estate trends.

Buyer

December 16, 2025

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

Seller

December 12, 2025

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise...

Seller

December 11, 2025

Spring gets all the attention, but it’s not always the best time to sell a house.

Seller

December 9, 2025

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair.

December 4, 2025

Buyer

December 2, 2025

Focus on homes that have been sitting on the market for a while.

We Guide Homeowners through the complicated process of selling their home using our 4 Phase Selling Process and 3 Prong Marketing Strategy that alleviates their stress and moves them effortlessly to their next destination. Schedule a 15 Minute Complimentary Strategy Session Today